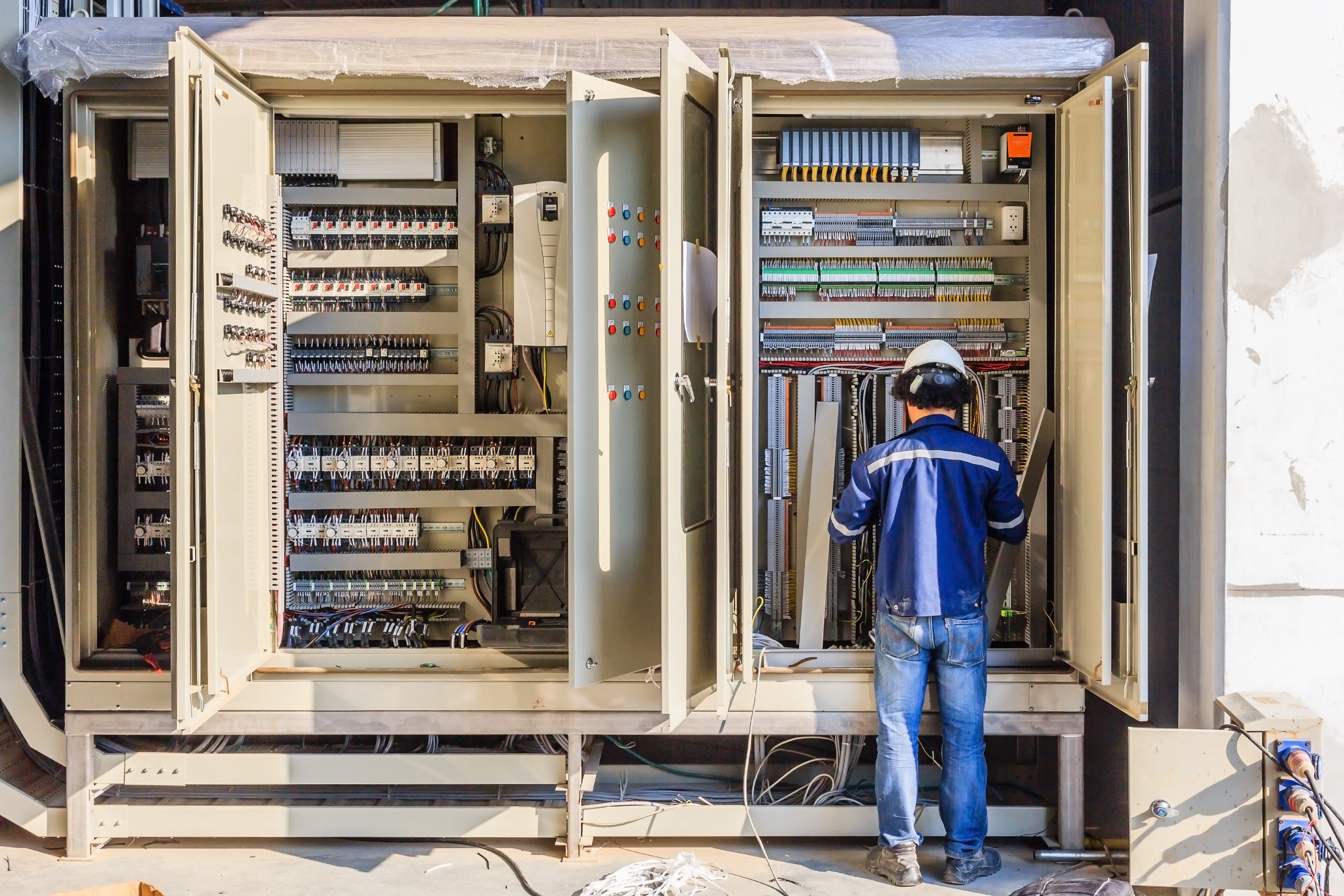

In case you missed it, Servato made a big announcement before the 4th of July. We added Roy Clingman, formerly of Vertiv, as our VP of Business Development. You can read the full press release below. Welcome aboard Roy!

NEW ORLEANS--(BUSINESS WIRE)--Servato Corp., a leading provider of power management solutions, today announced the hiring of Roy Clingman to lead its Business Development efforts. Clingman most recently was VP of Sales at Vertiv, where he held a number of different leadership roles in Vertiv’s sales organization including senior account responsibility for AT&T, the Cable TV segment, and North American OEM sales.

[…]